The Pacific Point Realty Fund

The Advantages

Why Investors Turn To Pacific Point

Attractive Returns

Attractive Returns

Hassle Free

Hassle Free

Stable Income

Stable Income

Diversified Portfolio

Diversified Portfolio

Financial Security

Financial Security

Get Started Easily

Get Started Easily

Our Investment Philosophy

1. Always put the client first

We treat your investment as if it were our own.

2. Focus on principal protection, while striving to maximize returns and minimize risks

Successful investing is first and foremost about risk management. We are fundamentally risk-averse, long-term focused investors who would rather give up some of the “upside” to mitigate and limit our downside risk. We invest in high quality, well-located assets which historically have been less susceptible to market declines.

3. Identify and target attractive markets with good long-term appreciation potential

We engage inefficient and fragmented markets that require specialized knowledge and expertise. We actively look for long-term trends and prefer to invest with the wind at our back.

4. Make investments in assets, people, and markets that we understand and know well

We seek investment opportunities that require capital, plus specialized knowledge and skills. This powerful combination generally results in higher returns per unit of risk and a strong point of view about value and investment risk factors.

5. Invest for the long-term and remain flexible

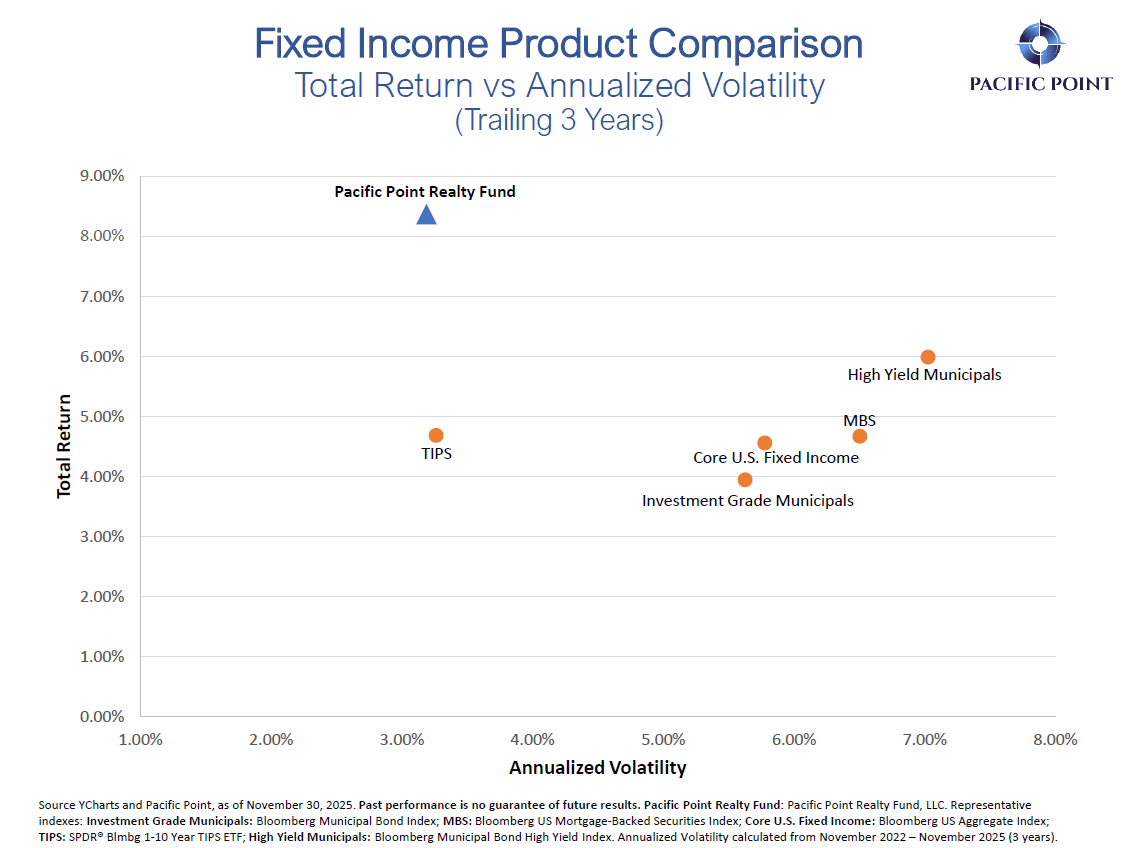

Markets continually evolve, and successful investors adapt to change. We aim to invest in a diversified pool of high-quality, well-located real estate assets that can provide a significant and reliable combination of income and long-term appreciation. Private money mortgages have been shown to reduce overall portfolio volatility and increase returns, as these assets are not highly correlated with either the stock or bond markets.

We Lend In These States

Arizona

California

Colorado

Idaho

Nevada

Oregon

Washington

Tax Benefits: Sub-REIT Structure

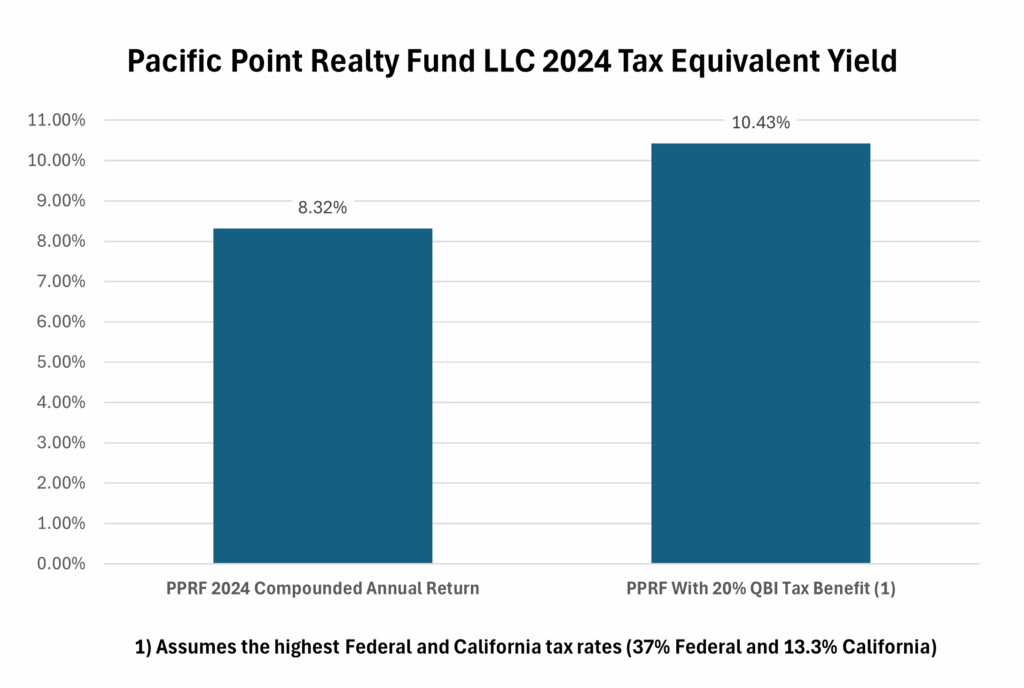

Pacific Point Realty Fund, LLC follows a Sub-REIT Structure to take advantage of the Qualified Business Income (QBI Section 199A), which allows noncorporate taxpayers to deduct up to 20% of the income from their combined qualified business income. A special provision in the law, Section 199A(b)(1)(B), provides that qualified dividends from REITs are deductible just the same as QBI. Importantly, there is no investor means testing or income limitation associated with REIT dividends. This effectively means that the conversion has allowed taxable investors to legally avoid paying taxes on 20% of the income from PPRF. The REIT structure also benefits non-taxable investors by blocking potential Unrelated Business Taxable Income (UBIT) taxes.

As shown in the chart below, the QBI tax benefit provides a valuable benefit to investors. If we assume the highest federal and California state tax rates, the tax-equivalent yield of the fund’s 2024 return of 8.32% would be 10.43%. This means that an investor in the Pacific Point Realty Fund would need to earn a 10.43% yield from a fully taxable investment to achieve the same after-tax return as the 8.32% yield from the fund.

Let Us Help

Are You Qualified To Invest?

The Pacific Point Realty Fund is open to accredited investors as defined by the Securities Act of 1933 under Rule 501 of Regulation D. Generally speaking, an accredited investor is an individual who individually, or jointly with a spouse, has a net worth that exceeds $1 million, excluding the value of their primary residence.